RBA Cash Rate: What will this mean for mortgage loans?

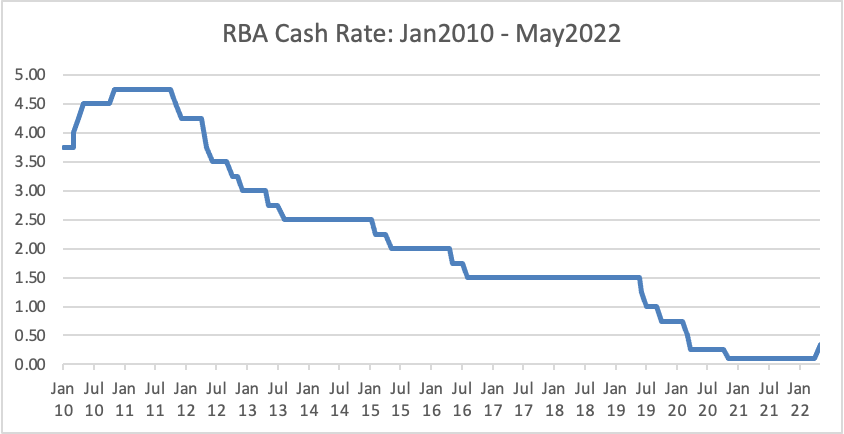

The last time interest rates were a hot topic was 3 years ago in the weeks & months before the last federal election in May 2019 (it would seem that some things never change!). The RBA cash rate was at a historic low (at the time) of 1.5%.

Depending on the lender, variable rates were around 3.7% climbing to over 4% by the end of the year. The general consensus at the time was that rates were going to rise after the election. But wages remained flat & inflation was still too low, stifling economic growth.

Then the Covid pandemic hit Australian shores in early 2020 & the RBA along with central banks around the world reduced interest rates to record lows & governments injected 100’s of billions of dollars to buoy their economies.

For the most part it worked, certainly for Australia.

But those super low-interest rates were for emergency relief during Covid to minimise pressure on homeowners & small businesses. These levels can’t last in a healthy economy as interest rates need a natural balance so that savers, borrowers & investors can all benefit.

As a visual, balanced interest rates keep the economy turning rather than flat-lining in a single direction to oblivion.

One of the reasons for increasing the RBA cash rate is to put downward pressure on inflation, which has remained stubbornly low for years but has just flown right through the target band of (2-3%) to 5.1%. The drivers of this surge are not the usual suspects.

Disruptions to supply chains, particularly building materials (Covid related) is one reason & the impact of increased energy & fuel prices as a result of the Russian invasion of Ukraine is another (though these were increasing already) which follows through to a multitude of consumer products where the cost to manufacture & transport products increase.

The RBA is of course conscious of the impact that increased interest rates will have on mortgage holders. With this in mind, I believe that rate increases will be steady & monitored.

With this first 0.25% increase (from 0.10% to 0.35%) in interest rates since November 2010 being announced today (3May22), it is likely there will be another ~0.50% increase before the end of 2022, a further 1% of increases throughout 2023 plateauing out in 2024 to a level around 2.50%.

Having said this, if inflation comes back into the target band & wages increase to a level that these economic contributors can live in tandem, rates may level out sooner.

Sign up to Newsletter

Weekly updates on business sales and advice, delivered to your inbox.

What will this mean for mortgage loans?

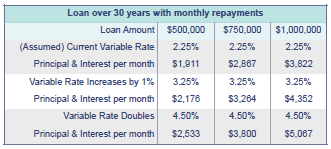

A lot of people think that if their interest rate doubles so will their loan repayments. You’ll be happy to know that this isn’t true!

A home loan comprises the repayment of two components:

- Principle: which is paid down over the (usually) 30 year term

- Interest: which will vary depending on the balance & the interest rate

Banks generally increase their variable rates in-line with & soon after the RBA cash rate announcements (1st Tuesday of each month) so it’s time to get ready. Expect an increase of 1% to your variable rate loan before the end of this year & another 1% - 1.5% by the end of 2024.

This table shows how it may affect repayments for your variable home loan. For those of you with a fixed-rate loan . . . you can relax for a while.

What should you do?

My thoughts are that it’s too late to fix a variable rate now as the increase has already been factored into the fixed rates & you’ll just be paying an unnecessary premium upfront.

To manage the forecast increases & as a general rule you should always try to make extra repayments into your offset account to prepare for future rate increases . . . & be prepared for any unexpected event! Even if you have a low fixed-rate loan, start making extra repayments now to get used to a new era in interest rates & to give yourself a buffer if needed.

Of course, you know that if you would like to discuss your individual situation, you can always call or email me directly. I’ll be happy to review your loan & give you an idea of what your future repayments may be.

Mary Grant

Principal

Clear Options Finance

Tags: finance funding 2022 government