Don’t Sell a Business - Until You Understand Your Tax Obligations

Don’t Sell a Business - Until You Understand Your Tax Obligations

You don’t need to be a tax guru, but there are some things you need to understand.

You don’t need me to tell you that selling your business is a big deal.

It’s your chance to cash in on the years of hard work, lost family time, and mental stress you have invested. Often, the business is your superannuation or the seed capital for your next venture.

Your desire to realise as much as possible is natural.

Giving any of that to the ATO (Australian Tax Office, in case you need reminding) is painful at the best of times, so minimising your contribution to the Canberra blackhole is essential.

The good news is that paying no capital gains tax is possible.

Your accountant will do most of the heavy lifting here and a good accountant will also help you make the important decisions. But knowing the taxation basics beforehand will save you time and dollars.

Here are a few basics to get you started.

The Importance of Ownership

If a company owns the business, you have the option of selling the business or the shares in the company. As a vendor, selling the shares is often the best taxation outcome as all gains will be capital gains and, therefore, easier to retain tax-free.

However, although there are no immediate tax detriments for the purchaser, buying shares is fraught with danger. Typically, a purchaser will opt to avoid buying shares.

If the company's business assets include special licences/leases/agreements that are not easily transferable, selling the shares may be the only viable option.

For other ownership structures (sole trader/partnership/trust), you will be selling the business assets, hopefully as a going concern. In this case, you will deal with a combination of income and capital gains tax exposures.

Income Tax

Although selling your business is primarily an asset sale, some components of the transaction may affect your profit (and, therefore, your income tax) position. The main ones are -

1. Trading stock

“Plus stock at valuation” is a common condition in business sale agreements.

Where trading stock is significant, an independent valuer may be appointed, but there is always room for negotiation. You need to understand the taxation implications of the valuation.

Like the annual end-of-year valuation in your income tax return, a higher valuation will increase the business profit, so consider how that will affect your income tax outcome.

And a warning - don’t declare a sale valuation significantly higher than the amounts included in past tax returns. Depending on the amounts involved, the ATO may conclude that you have been understating your past income.

2. Depreciated assets

Over recent years, you may have taken advantage of the instant asset write-off concessions available to small businesses.

Any portion of the sale price attributed to those assets will need to be included as a “Profit on Sale” of those assets.

It is unusual to include that allocation in the sale agreement. Typically, both parties would make their independent allocations post-sale. You, therefore, have some “wriggle room”. But again, if the amount involved is significant, an unjustifiably low valuation may pique the ATO’s interest.

3. Uncollected debts

If the business accounts are prepared on an accrual basis, you may claim a deduction for any debts existing at the sale date that are not collected.

Uncollected debts are ignored for businesses accounting on a cash basis.

Any of these income tax liabilities may be able to be avoided by making a concessional superannuation contribution.

Capital Gains Tax (CGT)

The impact of CGT is far more complex than income tax. There is a minefield to navigate, which can materially alter the outcome. So DO NOT make any final decisions until you have consulted your accountant.

As stated at the start, all you can aim for is a general awareness of the possibilities and potential issues which may apply in your situation.

Eligibility

Before considering any exemptions or concessions available, you must pass the eligibility tests. These are

-

Your business must be a small business entity with an aggregated turnover of less than $2 million, and your net assets must be less than $6 million.

-

The asset must be an active asset. It would be unusual for a business to fail this test, but some assets (e.g., shares or property) may not be considered active even if the business owns them.

-

For companies or trusts, there must be a significant individual. A significant individual would typically be you or your spouse holding at least 20% of the control of the business.

What could trick you? Aggregated turnover includes the turnover of affiliates where you control the business activities, so aggregation may cause you to fail the test. Similarly, net assets can include assets owned by affiliates.

Assuming you’ve cleared the eligibility hurdle, we can consider some options. The exemptions and concessions are not mutually exclusive. You can apply more than one to achieve the required result.

Exemptions

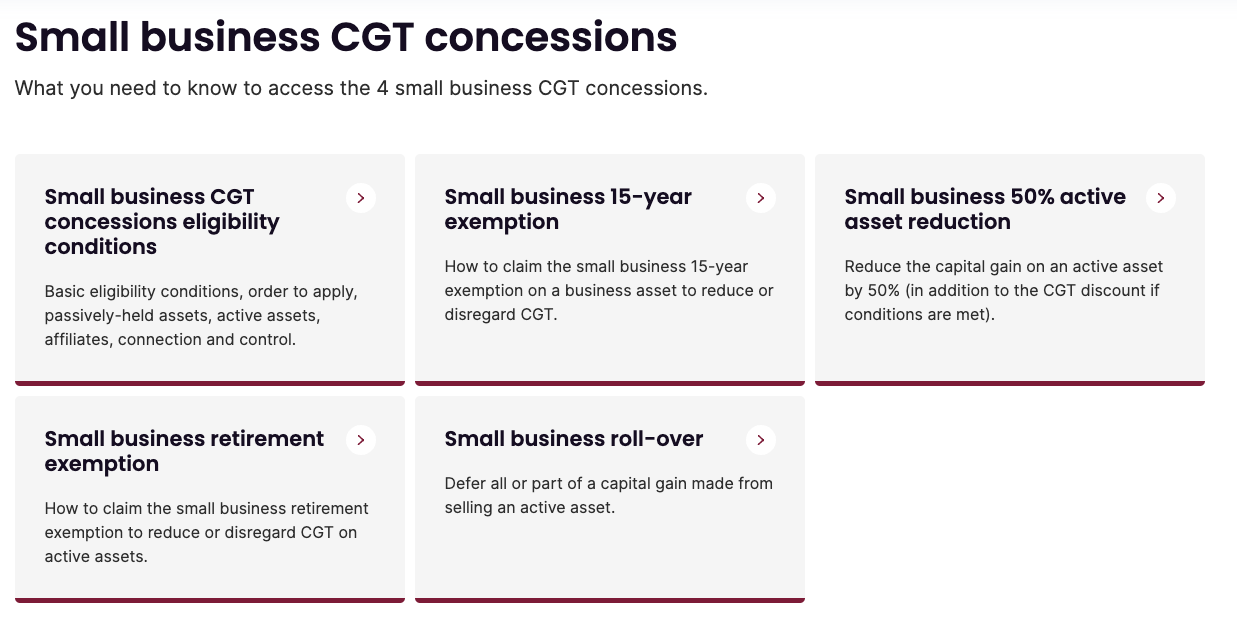

The exemptions you could apply for change over time. So its important to check with the ATO, these are the current concessions in March 2025.

-

If you have owned the active asset for at least 15 years, are over 55, and are retiring, 100% of the capital gain will not be subject to CGT.

-

If you have owned the active asset for at least a year, you are entitled to the 50% general CGT exemption plus a further 50% reduction. Effectively, this means that 75% of the capital gain is exempt from CGT.

-

Capital gains made when selling an active asset may be exempt. You are allowed a lifetime CGT-free exemption of $500,000. If you are under 55, you must contribute this exempt amount to your superannuation account.

What could trick you? For the 15-year exemption to apply, you must retire. That doesn’t mean you have to stay retired. Retiring at 55 may appeal to some, but for others, returning to some form of activity after a period of retirement is necessary - it’s still your call.

Concessions

Any non-exempt capital gain will be taxed unless you apply the CGT concession available to business owners.

You can defer the capital gain made (and therefore CGT) by applying the small business rollover concession. This concession allows you to reduce the cost base of any other active asset you purchased in the previous 12 months or will purchase in the next two years.

The downside is that when you finally sell the replacement active asset, the capital gain could be higher as it will include the deferred capital gain. But, all the exemptions discussed above will still apply to the “new” capital gain, and your age/retirement status may mean more exemptions will apply.

So, where to from here?

Feeling confused is quite natural, but armed with this information, you now have a general idea of the issues involved when you consult your accountant.

Ask your accountant to set out your tax plan in writing well before the sale so you can understand how income tax & CGT may affect you post-sale.

If applicable, plan your retirement (however brief that happens to be).

And plan what you will do with the sale proceeds now that your accountant has helped you avoid sending any of it to Canberra!

Originally Published: 2023

Updated: March 2025

About the author