Queensland Continues to be Australia’s Top State for Business Sales

Queensland Continues to be Australia’s Top State for Business Sales

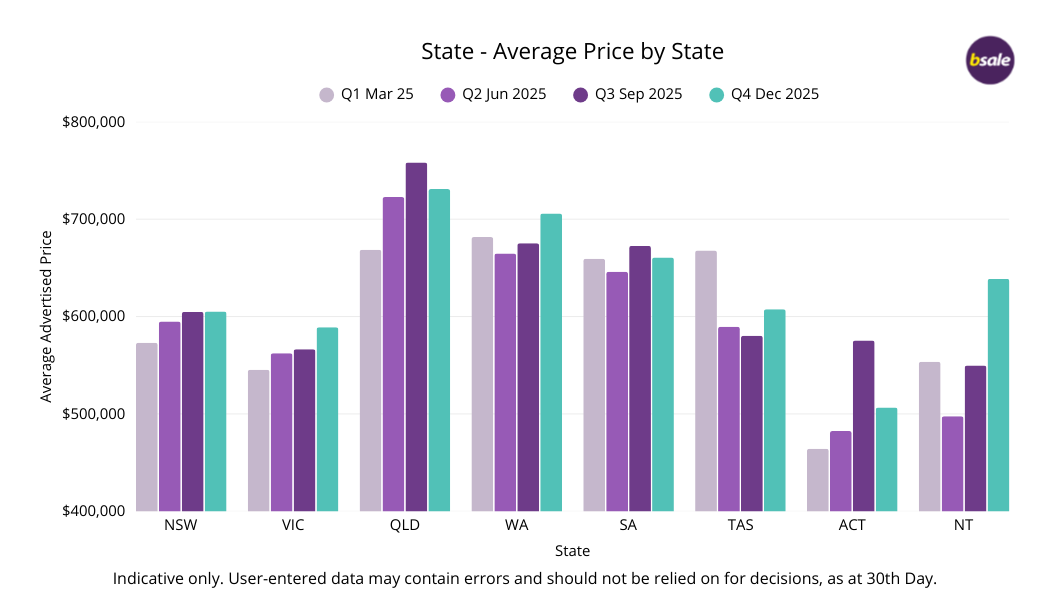

Queensland continues to dominate Australia’s business for sale market on price, holding its position as the highest-priced state nationally based on average advertised asking prices.

According to the Bsale Market Report (January 2026), Australia’s business for sale market currently comprises 16,033 active listings with a combined advertised value of $10.56 billion. The national average asking price sits at $658,623, providing essential context for comparing state and capital city performance.

Queensland Leads All States

Queensland ranks number one nationally for business asking prices, with an average advertised value of $730,974 across 3,693 active listings, representing a combined market value of approximately $2.70 billion.

This places the Queensland business for sale market clearly ahead of every other state, including Western Australia ($705,700), South Australia ($660,742), Tasmania ($607,379), New South Wales ($605,147) and Victoria ($589,072).

Queensland’s sustained pricing leadership is underpinned by the scale of the Brisbane market alongside a concentration of high-value regional centres, where established, profitable businesses and operations capable of supporting growth or management structures continue to attract strong buyer demand.

How Capital Cities Compare

Capital city markets show clear variation in both scale and pricing, based on advertised listings.

Hobart records the highest average asking price of any capital city at $727,831, despite a relatively small market of 198 listings. Limited supply and tightly held businesses continue to support elevated pricing.

Brisbane follows closely, with an average asking price of $689,727 across 1,808 listings, reinforcing its position as one of Australia’s strongest capital city business markets.

Perth ($672,082) and Adelaide ($667,502) form the next tier, supported by consistent demand across trade, service and industrial sectors.

At the more affordable end of the capital city spectrum, Melbourne averages $558,863 across 3,119 listings, while Sydney, despite being Australia’s largest market by volume, records an average asking price of $524,934. Canberra remains the most affordable capital city market, with an average asking price of $494,657.

Market Size vs Market Value

Sydney and Melbourne together account for more than 6,200 advertised listings, making them the largest business markets in Australia by volume. However, both capitals sit below the national average asking price, reflecting a high concentration of owner-operated, hospitality and service-based businesses.

By contrast, Queensland’s higher average pricing is underpinned by a stronger mix of mid-scale and larger regional businesses, particularly outside Brisbane, where fewer low-value listings dilute the state average.

Why This Is Happening

Queensland’s sustained leadership in business pricing is being reinforced by a combination of economic policy, population growth, asset values and long-term investment confidence, rather than short-term market conditions.

Government-backed infrastructure investment and small business support initiatives have strengthened buyer confidence across the state, particularly in regional Queensland. These factors continue to support demand for established businesses with proven earnings in sectors such as construction, transport, health, tourism and professional services.

Queensland has also benefited from ongoing interstate migration and business visa activity, with the state remaining attractive to buyers seeking business ownership pathways alongside lifestyle and residency opportunities. This has supported demand for profitable, compliant businesses that meet operational and visa-related requirements.

Rising residential and commercial property values have further influenced business pricing. In many Queensland regions, businesses are increasingly linked to valuable underlying real estate, whether through freehold ownership or long-term leases in appreciating locations.

Looking ahead, long-term confidence is being reinforced by major events such as the Brisbane 2032 Olympic and Paralympic Games, which continue to drive infrastructure spending, population growth and investment across South East Queensland and surrounding regions. Buyers are clearly factoring future demand into current acquisition decisions.

Combined with strong population growth and decentralisation trends, these factors have helped Queensland maintain higher advertised business prices relative to other states. Rather than being driven by short-term market cycles, Queensland’s pricing reflects structural demand and long-term confidence, particularly for established, scalable businesses.

What This Means for Buyers and Sellers

Queensland’s pricing leadership reflects a market with a higher concentration of profitable, scalable businesses, including a greater share of opportunities with freehold or part-freehold components, particularly in regional centres.

For buyers, this reinforces the importance of looking beyond headline price and assessing earnings quality, asset inclusion and long-term growth potential. Higher asking prices in Queensland often indicate stronger underlying cash flow and operational maturity.

For sellers, Queensland’s position at the top of the pricing ladder highlights the value of aligning asking prices with current market benchmarks, supported by clear financials and realistic expectations. The market continues to reward well-presented businesses with demonstrable profitability.

Based on advertised listing prices, Queensland remains Australia’s leading state for business pricing, while capital city markets increasingly diverge based on supply mix, asset inclusion and business scale, rather than location alone.

It’s important to note that Bsale Market data is compiled from user-entered listing information and, due to the nature of business sales, should be used as a general guide only. Advertised prices and details may change or contain inaccuracies, and all figures should be independently verified through appropriate due diligence and professional advice.

As buyer interest continues to expand beyond traditional metropolitan centres, understanding these state-level and capital city differences is becoming essential for anyone buying or selling a business in 2026.

Tags: queensland brisbane business sales market insights

About the author

Vanessa Lovie-Yousaf

CEO Bsale Australia

Vanessa Lovie-Yousaf is the CEO and manager of Bsale.com.au, one of Australia’s most trusted business for sale marketplaces since 2000. With 15 ...