NSW in Lockdown: Government Support for Small Business

Covid 19 Support for NSW Businesses

As COVID-19 continues to spread through communities businesses are feeling the pressure with forced lockdowns and restrictions. Sydney is now entering 9 weeks of lockdowns which is much longer than expected. With cases reaching 800+ per day, the end of this lockdown seems far away.

We take a look at the current grants and support available to NSW businesses. There is high demand for business support, with many calling the current aids insufficient to survive.

“We are losing thousands weekly. I have 50 new cars sitting in my parking lot, with no drivers. All of my clients have demanded discounts as there is no work available. Uber, Ola, Taxi are sitting still. The support isn’t enough. We need to come out of this lockdown” Mr Rasheed, Car Rental Operator.

Speaking with business owners who are experiencing extended lockdowns in Sydney and Melbourne, many express the stress they are under. While Government support is available, with very little income it will be hard for many businesses to recover. A lot of the expenses now fall on the business owners shoulders.

Small businesses are the backbone of the Australian economy and are essential to many communities. This is why it’s imperative that the Government provides support in these uncertain times.

With changing environments, details about grants and support are always changing, it’s important to check the Government websites for current information.

NSW Support

Covid-19 Business Grant

This is available to businesses who experienced at least a 30% loss during the initial 3 week lockdown period.

Eligibility: Must have experienced a minimum of 30% loss during the period equivalent to the same period in 2019, 2020 or the 2 week period before lockdown.

Turnover: $75,000+ and payroll up to $10 million.

Dates: 26 June to 17 July 2021

Payment:

Tier 1: $7,500 for a decline of 30% or more

Tier 2: $10,500 for a decline of 50% or more

Tier 3: $15,000 for a decline of 70% or more

Application close 13 September 2021.

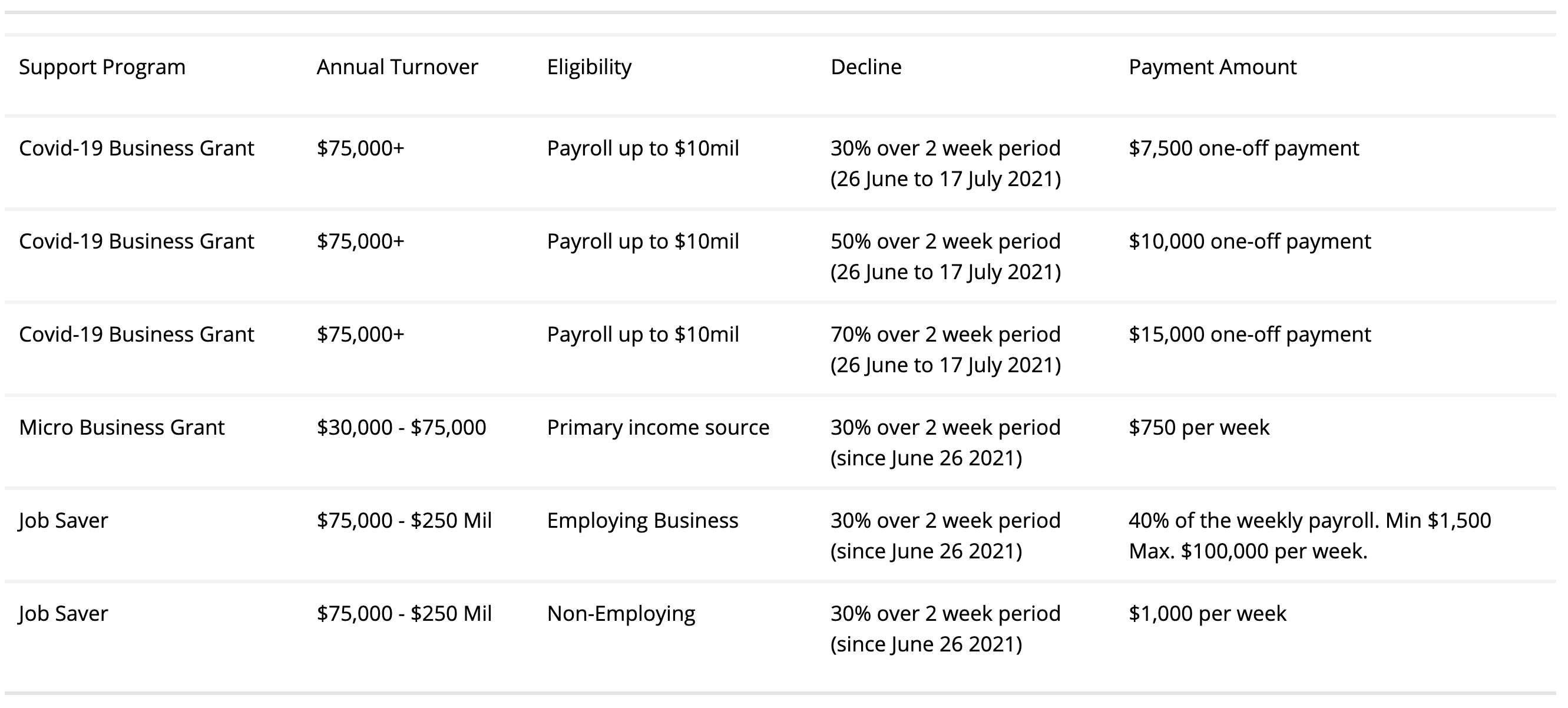

Chart of Support Programs

COVID-19 Micro Business Grants

If you’re a micro-business such as a sole trader, not-for-profit with a turnover between $30,000 and $75,000 you may be eligible for this grant.

Eligibility: Demonstrate a 30% reduction in turnover. Must be the primary source of income for the person applying.

Turnover: $30,000 and $75,000.

Payment: $750 per week

Apply Covid-19 Micro Business Grant

$750 per week available for businesses with turnover between $30,000 - $75,000.

Job Saver

Jobkeeper hasn’t been available during this round of restrictions, instead, the Government announced JobSaver. The aim is to provide cash flow to businesses and to ensure employee headcount is maintained from 13 July 2021.

Eligibility: Experienced at least a 30% loss over a 2 week period since 26 June, equivalent to 2019 or 2020 or 2 weeks before lockdown.

Turnover: $75,000 - $250 million

Payment: The payment will be equivalent to 40% of the weekly payroll for work performed in NSW: Min. payment will be $1,500 per week Max. payment will be $100,000 per week.

Non-employing businesses, such as sole traders, may be eligible to receive a payment of $1,000 per week.

Payroll Tax Deferrals

Any business paying payroll tax can choose to defer payments on the 2020-21 annual reconciliation return and wages paid in July and August. Interest-free repayment plans for up to 12 months will be available.

Payroll Tax Concessions

If your business pays wages of between $1.2 million and $10 million, it may be eligible for a 25% payroll tax waiver for the 2021-2022 financial year. It must have experienced a 30% decline equivalent to 2019 or 2020.

Commercial or Retail Premises

Landlords will need to engage in mediation with tenants before they can evict them. Impacted tenants are protected by the Small Business Commissioner. Negotiations may result in deferred payments, rent reductions or similar outcomes.

Accommodation and creative arts

Financial support will be available for eligible tourism accommodation providers that have lost business between 25 June and 11 July due to lockdown.

Amounts will be based on the number of cancelled ‘room nights’ as follows:

$2,000 for up to 10 room nights

$5,000 for 11 or more room nights

Visit NSW Government website for COVID-19 Support Package details.

Not sure which grants?

Try the COVID-19 Assistance Finder which will ask a series of questions about your business and match you to the most suitable options.

Business owners are struggling. It's not that easy to hit pause on a business, and to think covering 40% of wages is enough to stay afloat, where is the other 60% coming from? Many businesses are earning $0 during this period. A pathway out of these lockdowns needs to be established.

Business sales are still occurring across Sydney with many reports of successful transactions through lockdowns. Business owners know this is temporary, they know businesses are designed to last for years and even generations. Business Brokers are accounting for these restrictions in their appraisals.

Tags: covid-19 government grants government support

About the author

Vanessa Lovie

CEO Bsale Australia

Vanessa is the current manager and CEO of Bsale Australia. Over the past 11 years as a business owner, she understands what it takes to grow a ...